Machine Learning for Fraud Detection in Finance

Fraud is a major problem for the financial industry. In 2020, the global cost of fraud was estimated to be \$3.5 trillion. Financial institutions are constantly looking for new ways to detect and prevent fraud, and machine learning is playing an increasingly important role.

Machine learning algorithms can be used to identify patterns in data that are indicative of fraud. This data can include customer information, transaction history, and account activity. Machine learning models can be trained to learn these patterns and flag transactions that are suspicious.

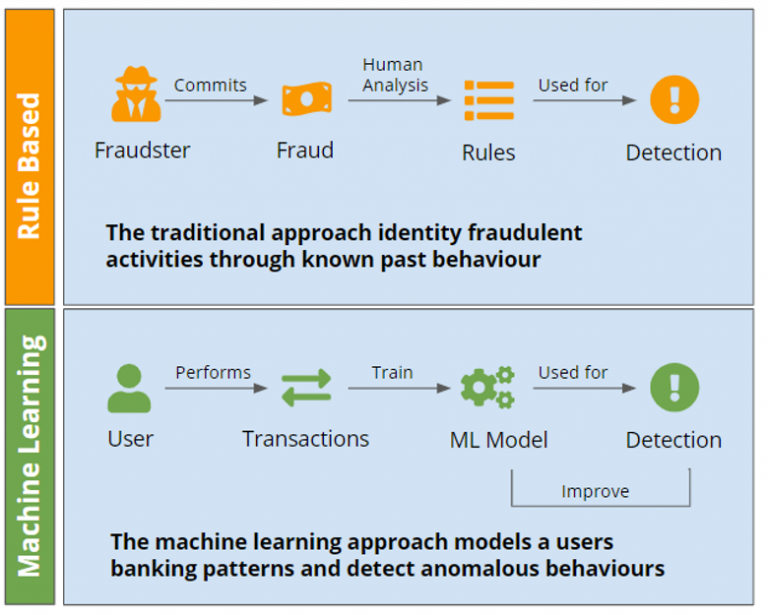

Machine learning for fraud detection can offer a number of benefits over traditional fraud detection methods. Traditional methods are often rule-based, which means that they rely on a set of pre-defined rules to identify fraudulent transactions. These rules can be difficult to keep up-to-date, as fraudsters are constantly finding new ways to circumvent them. Machine learning models, on the other hand, are not limited by pre-defined rules. They can learn new patterns as they encounter new data, making them more adaptable to changing fraud trends.

Machine learning models can also be more scalable than traditional fraud detection methods. Traditional methods often require a lot of manual work to create and maintain the rules. Machine learning models can be trained automatically, and they can be applied to large datasets without the need for human intervention.

Despite the benefits of machine learning for fraud detection, there are also some challenges that need to be considered. One challenge is that machine learning models can be biased. This can happen if the training data is not representative of the population of transactions that the model will be used to detect. Another challenge is that machine learning models can be complex. This can make them difficult to understand and explain, which can lead to concerns about fairness and accountability.

Despite these challenges, machine learning is a promising tool for fraud detection in the financial industry. Machine learning models can help financial institutions to identify fraudulent transactions more effectively and efficiently than traditional methods. This can help to protect consumers from fraud and reduce the financial losses that financial institutions suffer.

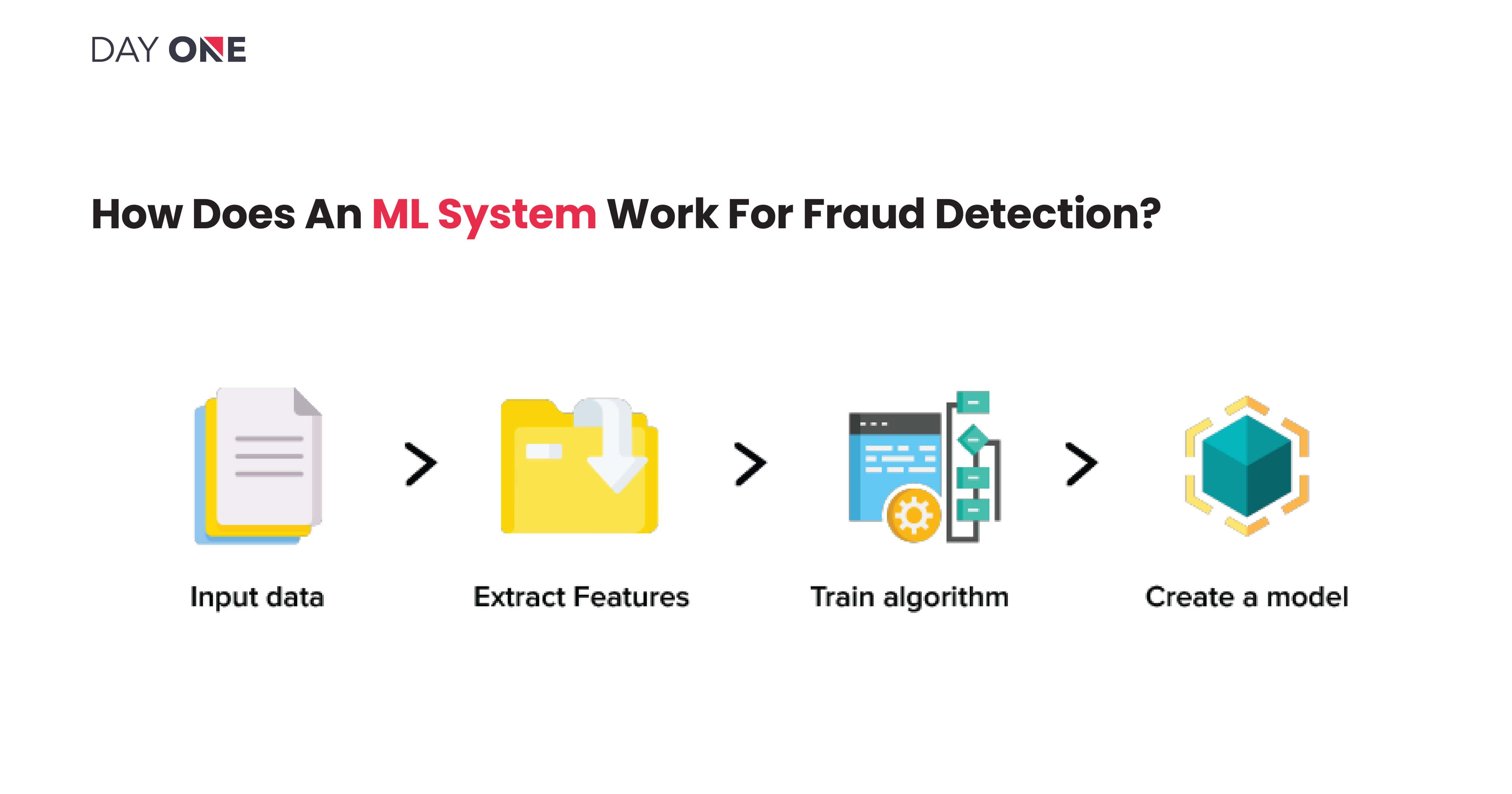

How Machine Learning Works for Fraud Detection

Machine learning algorithms are trained on data that is known to be fraudulent. This data is used to teach the algorithm to identify the features that are common to fraudulent transactions. Once the algorithm is trained, it can be used to flag new transactions that are similar to the fraudulent transactions in the training data.

The features that are used to train machine learning models for fraud detection can vary depending on the type of data that is available. Some of the most common features include:

- Customer information: This includes information such as the customer's name, address, phone number, and email address.

- Transaction history: This includes information about the customer's previous transactions, such as the amount of the transactions, the time of the transactions, and the merchant where the transactions were made.

- Account activity: This includes information about the customer's account activity, such as the number of logins, the amount of money that is deposited and withdrawn, and the transactions that are made.

Machine learning algorithms can be used to identify fraudulent transactions in a variety of ways. Some of the most common methods include:

- Anomaly detection: This method identifies transactions that are significantly different from the other transactions in the dataset. These transactions are then flagged for further investigation.

- Pattern recognition: This method identifies transactions that follow a pattern that is known to be associated with fraud. These transactions are then flagged for further investigation.

- **Machine learning models can also be used to predict the likelihood that a transaction is fraudulent. This information can be used to prioritize which transactions should be investigated further.

The Benefits of Machine Learning for Fraud Detection

Machine learning offers a number of benefits for fraud detection in the financial industry. These benefits include:

- Improved accuracy: Machine learning models can identify fraudulent transactions more accurately than traditional fraud detection methods. This is because machine learning models can learn to identify the features that are common to fraudulent transactions, even if these features are not explicitly known.

- Scalability: Machine learning models can be applied to large datasets without the need for human intervention. This makes them a scalable solution for fraud detection in financial institutions that process a large volume of transactions.

- Adaptability: Machine learning models can learn new patterns as they encounter new data. This makes them adaptable to changing fraud trends.

The Challenges of Machine Learning for Fraud Detection

There are also some challenges that need to be considered when using machine learning for fraud detection. These challenges include:

- Bias: Machine learning models can be biased if the training data is not representative of the population of transactions that the model will be used to detect. This can lead to the model incorrectly flagging legitimate transactions as fraudulent.

- Complexity: Machine learning models can be complex. This can make them difficult to understand and explain, which

Post a Comment