Artificial Intelligence (AI)-Based Personalized Financial Advice: The Future of Wealth Management

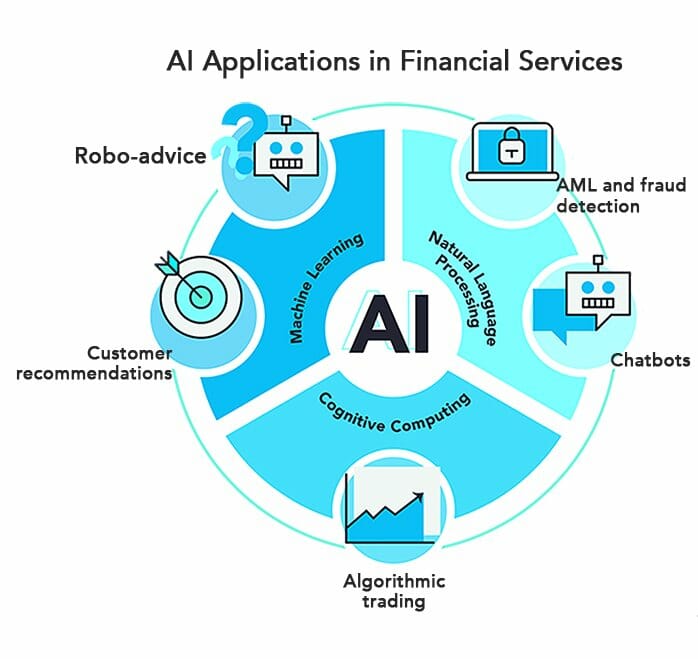

The financial services industry is undergoing a major transformation, driven by the rapid adoption of artificial intelligence (AI) and machine learning (ML) technologies. These technologies are enabling financial institutions to offer new and innovative services to their customers, such as personalized financial advice, automated investment management, and fraud detection.

AI-based personalized financial advice is one of the most promising applications of AI in the financial services industry. By using data from a customer's financial transactions, investment portfolio, and other sources, AI-powered financial advisors can provide tailored advice that is tailored to the individual's specific needs and goals.

This type of advice can be extremely valuable for investors, who often have difficulty making informed decisions about their finances. AI-based financial advisors can help investors to identify potential risks and opportunities, develop investment strategies that are aligned with their goals, and track their progress over time.

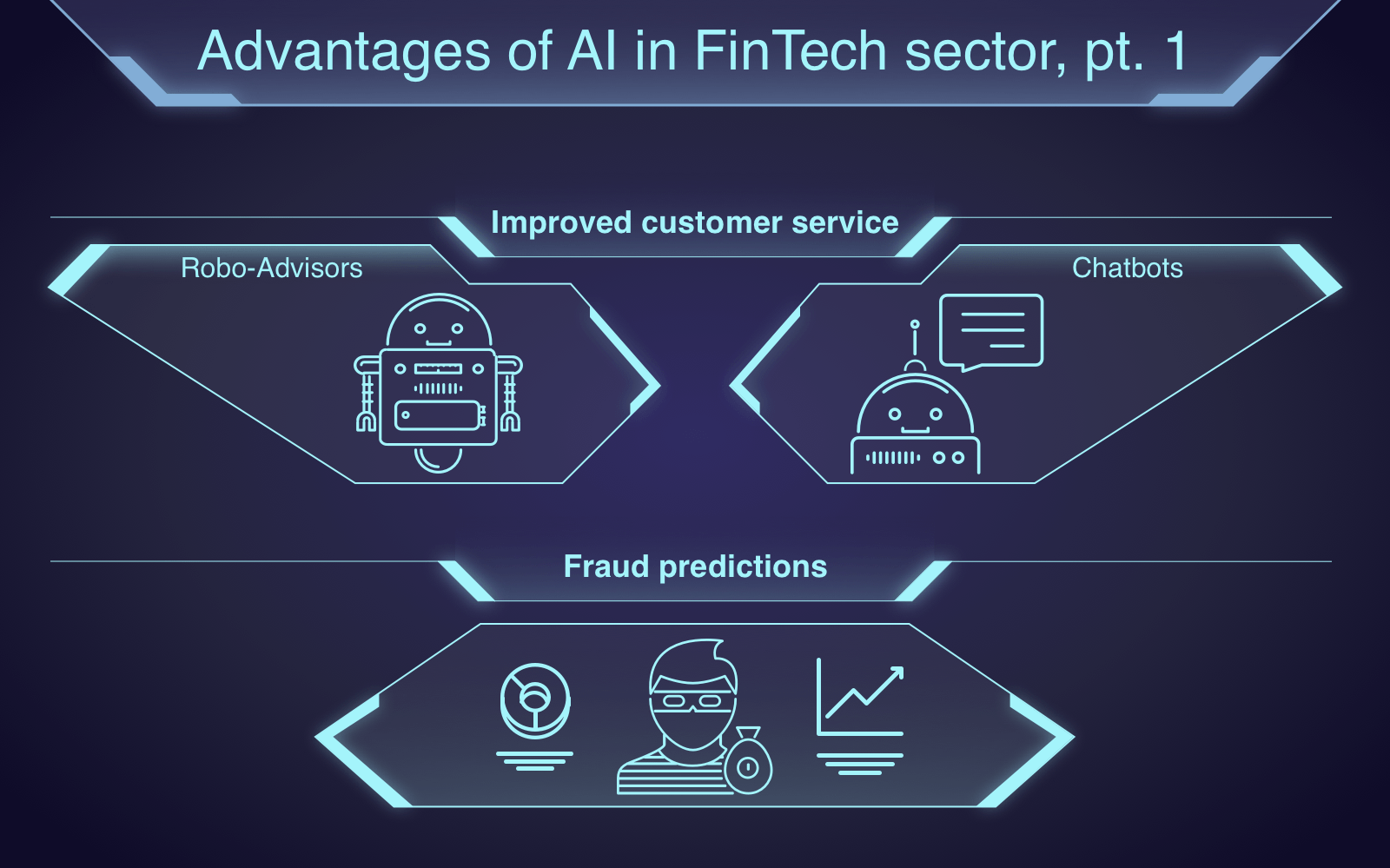

In addition to providing personalized advice, AI-powered financial advisors can also automate many of the tasks that are traditionally associated with wealth management, such as portfolio rebalancing and tax optimization. This can save investors time and money, and it can also help them to improve their financial outcomes.

The use of AI in personalized financial advice is still in its early stages, but it is quickly gaining momentum. As the technology continues to develop, we can expect to see even more innovative and effective applications of AI in the financial services industry.

Benefits of AI-Based Personalized Financial Advice

There are a number of benefits to using AI-based personalized financial advice, including:

- Personalization: AI-powered financial advisors can provide tailored advice that is specific to the individual's needs and goals. This is in contrast to traditional financial advice, which is often based on a one-size-fits-all approach.

- Automation: AI-powered financial advisors can automate many of the tasks that are traditionally associated with wealth management, such as portfolio rebalancing and tax optimization. This can save investors time and money, and it can also help them to improve their financial outcomes.

- Accuracy: AI-powered financial advisors can use data from a variety of sources to make more accurate predictions about the future. This can help investors to make better decisions about their finances.

- Scalability: AI-powered financial advisors can be scaled to serve a large number of clients. This is in contrast to traditional financial advisors, who are often limited by the number of clients they can serve.

Challenges of AI-Based Personalized Financial Advice

There are also a number of challenges associated with AI-based personalized financial advice, including:

- Bias: AI models can be biased against certain groups of people, such as women and minorities. This is a potential problem that needs to be addressed before AI-powered financial advisors can be widely adopted.

- Transparency: AI models are often complex and opaque, which can make it difficult for investors to understand how they are making decisions. This lack of transparency can erode trust between investors and their financial advisors.

- Regulation: The use of AI in the financial services industry is still relatively new, and there is a lack of clear regulations governing how AI-powered financial advisors can operate. This could create a regulatory minefield for financial institutions that want to offer AI-based financial advice.

Conclusion

AI-based personalized financial advice is a promising new technology that has the potential to revolutionize the way that investors receive financial advice. However, there are a number of challenges that need to be addressed before AI-powered financial advisors can be widely adopted.

As the technology continues to develop, we can expect to see even more innovative and effective applications of AI in the financial services industry. This will have a major impact on the way that investors make financial decisions, and it will help them to achieve their financial goals more effectively.

How Does AI-Based Personalized Financial Advice Work?

AI-based personalized financial advice works by using a variety of data sources to create a comprehensive picture of the individual's financial situation. This data can include information such as:

- Financial transactions: The individual's income, expenses, and investments

- Investment portfolio: The individual's asset allocation and risk tolerance

- Personal goals: The individual's financial goals, such as retirement savings or college funding

- Other factors: The individual's age, income, and family situation

Once this data has been collected, AI models can be used to analyze the data and identify potential risks and opportunities. The models can also be used to generate personalized recommendations for the individual, such as:

- Investment strategies: The individual's asset allocation and risk tolerance

- Savings goals: The individual's retirement savings or college funding goals

- Budgeting tips: Ways for the individual to save money and reach their financial goals

Post a Comment