Machine Learning for Financial Forecasting

Financial forecasting is the process of predicting future financial events, such as stock prices, interest rates, and economic growth. It is a critical tool for investors, businesses, and governments, as it can help them make informed decisions about the future.

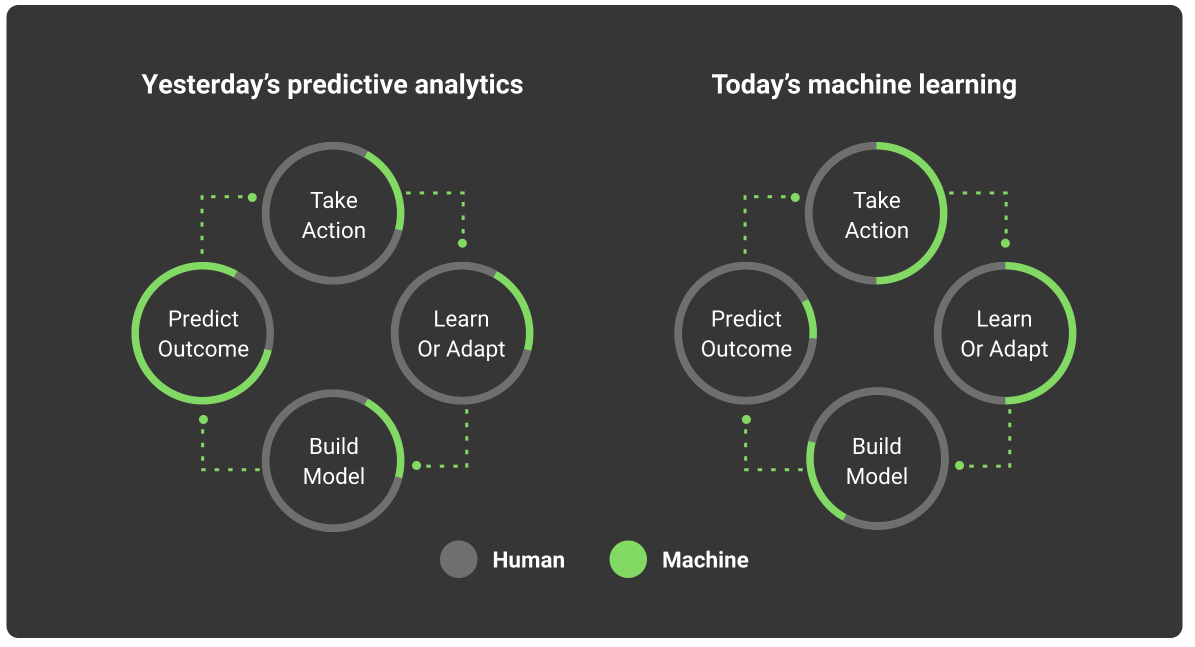

Traditionally, financial forecasting has been done using statistical methods such as linear regression and time series analysis. However, in recent years, machine learning (ML) has become increasingly popular for financial forecasting. ML algorithms can learn from historical data and identify patterns that can be used to make predictions about the future.

There are a number of advantages to using ML for financial forecasting. First, ML algorithms can be trained on very large datasets, which can provide more accurate predictions than traditional statistical methods. Second, ML algorithms are able to learn complex relationships between variables, which can lead to more accurate predictions. Third, ML algorithms can be updated in real time, which allows them to adapt to changing market conditions.

Despite the advantages of ML, there are also some challenges associated with using it for financial forecasting. First, ML algorithms can be complex and difficult to understand, which can make it difficult to interpret their predictions. Second, ML algorithms can be biased, which can lead to inaccurate predictions. Third, ML algorithms can be computationally expensive, which can make them impractical for use in real-time applications.

Despite these challenges, ML is still a powerful tool for financial forecasting. When used correctly, ML can provide accurate and reliable predictions that can help investors, businesses, and governments make better decisions.

How Machine Learning Works for Financial Forecasting

ML algorithms work by learning from historical data. They are trained on a dataset of past financial data, and then they are used to make predictions about future financial events. The training process involves feeding the ML algorithm data on past stock prices, interest rates, economic growth, and other financial variables. The algorithm then learns to identify patterns and relationships between these variables. Once the algorithm is trained, it can be used to make predictions about future financial events.

The specific ML algorithms that are used for financial forecasting vary depending on the specific task at hand. Some of the most common algorithms include linear regression, decision trees, random forests, and neural networks.

Benefits of Using Machine Learning for Financial Forecasting

There are a number of benefits to using ML for financial forecasting. These include:

- Accuracy: ML algorithms can learn from very large datasets, which can provide more accurate predictions than traditional statistical methods.

- Robustness: ML algorithms are able to learn complex relationships between variables, which can lead to more accurate predictions.

- Adaptability: ML algorithms can be updated in real time, which allows them to adapt to changing market conditions.

Challenges of Using Machine Learning for Financial Forecasting

There are also some challenges associated with using ML for financial forecasting. These include:

- Complexity: ML algorithms can be complex and difficult to understand, which can make it difficult to interpret their predictions.

- Bias: ML algorithms can be biased, which can lead to inaccurate predictions.

- Computational expense: ML algorithms can be computationally expensive, which can make them impractical for use in real-time applications.

Use Cases for Machine Learning in Financial Forecasting

ML is used for a wide variety of financial forecasting tasks, including:

- Stock price prediction: ML algorithms can be used to predict future stock prices. This information can be used by investors to make informed decisions about when to buy and sell stocks.

- Interest rate prediction: ML algorithms can be used to predict future interest rates. This information can be used by businesses to make decisions about when to borrow money and by investors to make decisions about when to invest in bonds.

- Economic growth prediction: ML algorithms can be used to predict future economic growth. This information can be used by governments to make decisions about fiscal policy and by businesses to make decisions about hiring and investment.

Conclusion

ML is a powerful tool for financial forecasting. When used correctly, ML can provide accurate and reliable predictions that can help investors, businesses, and governments make better decisions.

How to Get Started with Machine Learning for Financial Forecasting

If you are interested in getting started with ML for financial forecasting, there are a few things you will need to do.

First, you will need to gather data. This data should include historical financial data, such as stock prices, interest rates, and economic growth. You can find this data online from a variety of sources, such as the Securities and Exchange Commission (SEC) and the Federal Reserve.

Once you have gathered your data, you will need to choose an ML algorithm. There are a number of different algorithms that can be used for financial forecasting, such as linear regression, decision trees, random forests, and neural networks. The best algorithm for your task will depend on the specific data you

Post a Comment