Deep learning models for stock price prediction

Stock price prediction is a challenging task, as it involves forecasting a future value based on historical data. Traditional statistical methods have been used for this task for many years, but they often struggle to keep up with the ever-changing nature of the stock market. Deep learning models, on the other hand, have shown promising results in recent years, thanks to their ability to learn complex relationships between features and to make accurate predictions even in the presence of noise.

In this article, we will discuss the use of deep learning models for stock price prediction. We will start by introducing the basics of deep learning and then discuss how it can be applied to stock price prediction. We will then review some of the most successful deep learning models for stock price prediction and discuss their advantages and disadvantages. Finally, we will provide some tips on how to choose the right deep learning model for your own stock price prediction project.

Introduction to deep learning

Deep learning is a type of machine learning that uses artificial neural networks to learn from data. Neural networks are inspired by the human brain, and they are able to learn complex relationships between features by using a process called backpropagation. Backpropagation allows neural networks to adjust their weights and biases so that they can make more accurate predictions.

Deep learning models have been used successfully for a wide variety of tasks, including image classification, natural language processing, and speech recognition. In recent years, deep learning models have also been used for stock price prediction.

How deep learning can be used for stock price prediction

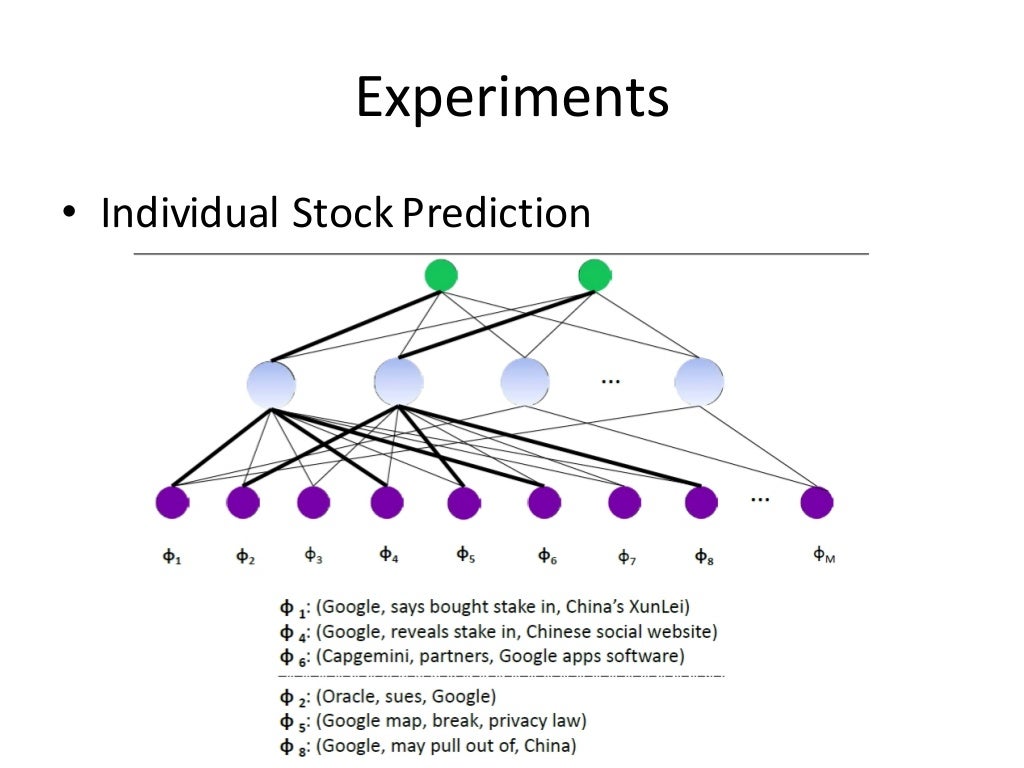

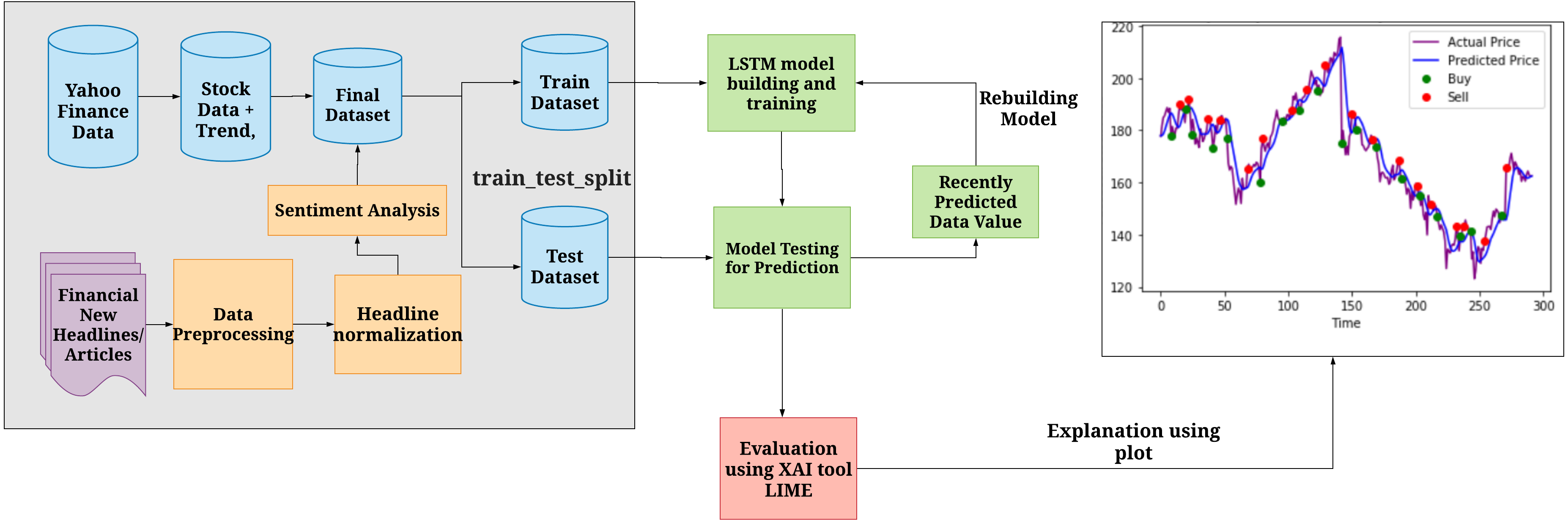

Deep learning models can be used for stock price prediction in a variety of ways. One common approach is to use a deep learning model to learn the relationship between historical stock prices and future stock prices. This can be done by using a supervised learning approach, in which the model is trained on a dataset of historical stock prices and corresponding future stock prices.

Another approach to stock price prediction with deep learning is to use a reinforcement learning approach. In reinforcement learning, the model learns how to make decisions by interacting with the environment. In the case of stock price prediction, the environment would be the stock market. The model would be given a reward for making good decisions, such as buying stocks that go up in value and selling stocks that go down in value.

Some of the most successful deep learning models for stock price prediction

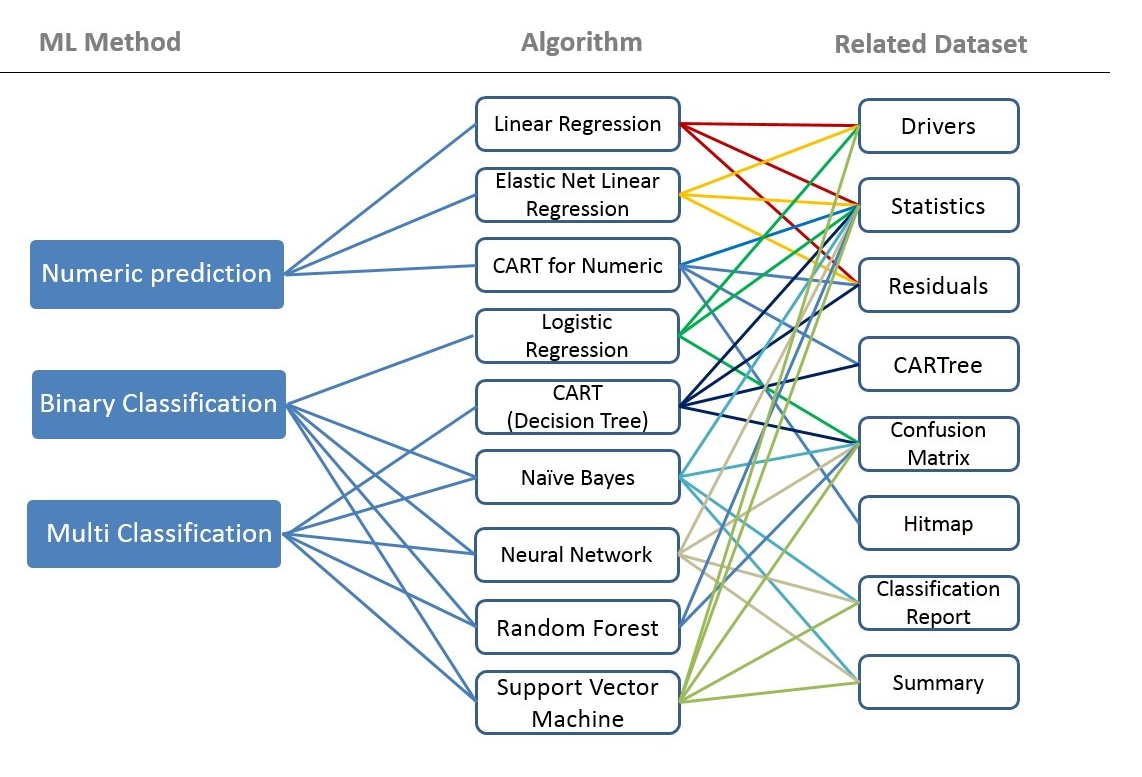

There are a number of different deep learning models that have been used successfully for stock price prediction. Some of the most successful models include:

- LSTMs (long short-term memory networks) are a type of recurrent neural network that is well-suited for time series prediction tasks. LSTMs have been used successfully for stock price prediction, as they are able to learn long-term dependencies between stock prices.

- CNNs (convolutional neural networks) are a type of neural network that is well-suited for image processing tasks. CNNs have been used successfully for stock price prediction, as they are able to identify patterns in stock price data.

- GANs (generative adversarial networks) are a type of neural network that can be used to generate new data. GANs have been used successfully for stock price prediction, as they can be used to generate realistic stock price forecasts.

Advantages and disadvantages of deep learning models for stock price prediction

Deep learning models offer a number of advantages over traditional statistical methods for stock price prediction. These advantages include:

- Accuracy: Deep learning models can often achieve higher accuracy than traditional statistical methods for stock price prediction. This is because deep learning models are able to learn complex relationships between features and to make accurate predictions even in the presence of noise.

- Robustness: Deep learning models are also more robust to outliers than traditional statistical methods. This is because deep learning models are able to learn the underlying distribution of the data, even if there are some data points that do not fit the distribution.

- Scalability: Deep learning models can be scaled to large datasets more easily than traditional statistical methods. This is because deep learning models can be trained on GPUs, which are much faster than CPUs.

However, deep learning models also have some disadvantages. These disadvantages include:

- Complexity: Deep learning models can be very complex, which can make them difficult to understand and debug.

- Data requirements: Deep learning models require a lot of data to train. This can make them impractical for use in small-scale stock price prediction projects.

- Overfitting: Deep learning models can sometimes overfit to the training data, which can lead to poor performance on new data.

Tips for choosing the right deep learning model for your stock price prediction project

When choosing a deep learning model for your stock price prediction project, there are a few factors you should consider. These factors include:

- The size of your dataset: If you have a small dataset, you

Post a Comment