Artificial Intelligence (AI)-Based Predictive Modeling for Insurance

Insurance is a risk management industry that provides financial protection against potential losses. The goal of insurance is to ensure that policyholders are compensated for their losses in the event of a covered event. Traditionally, insurance companies have used actuarial science to assess risk and set premiums. However, as the amount of data available to insurers has grown exponentially, so too has the potential for using AI-based predictive modeling to improve the accuracy and efficiency of insurance underwriting.

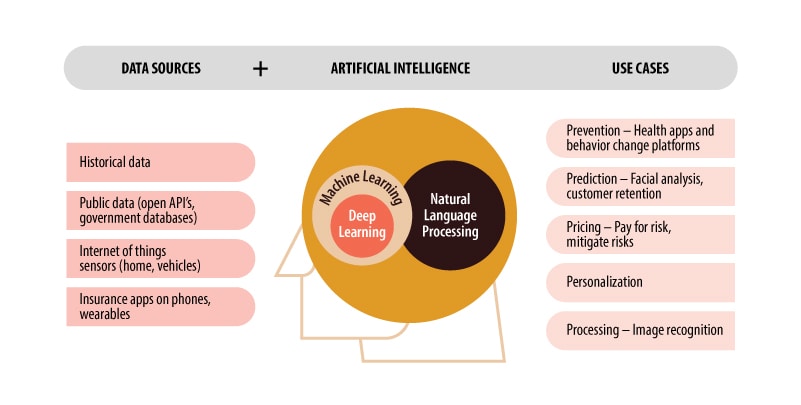

AI-based predictive modeling uses machine learning algorithms to identify patterns in data and make predictions about future events. This technology can be used to improve a wide range of insurance-related tasks, including:

- Underwriting: AI-based predictive models can help insurers identify high-risk policyholders and set premiums accordingly. This can help insurers to reduce their losses and improve their profitability.

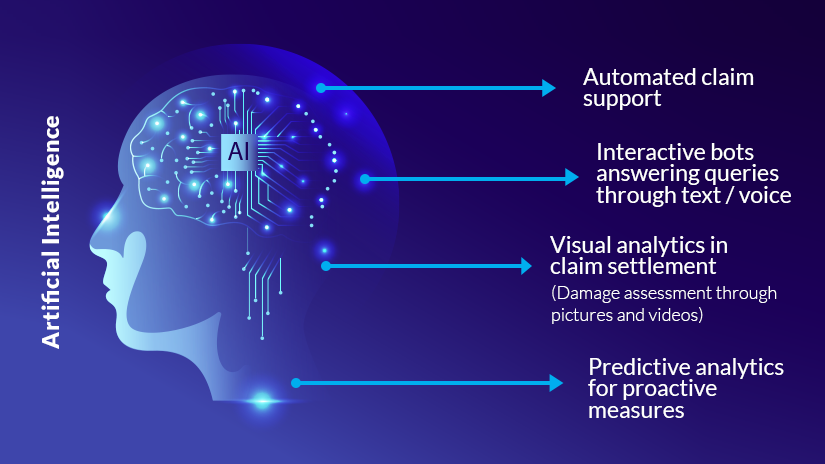

- Claims management: AI-based predictive models can help insurers to identify fraudulent claims and process legitimate claims more efficiently. This can help insurers to reduce their costs and improve customer satisfaction.

- Fraud prevention: AI-based predictive models can help insurers to identify potential fraudsters and prevent fraudulent claims from being filed. This can help insurers to protect their bottom line and ensure that policyholders are only compensated for legitimate losses.

In addition to the benefits listed above, AI-based predictive modeling can also help insurers to:

- Improve customer service: By providing insurers with more accurate and timely information, AI-based predictive models can help them to provide better service to their customers.

- Increase revenue: By identifying new opportunities and reducing costs, AI-based predictive models can help insurers to increase their revenue.

- Reduce risk: By helping insurers to identify and mitigate risks, AI-based predictive models can help them to reduce their overall risk exposure.

The potential benefits of AI-based predictive modeling for the insurance industry are significant. However, it is important to note that AI-based predictive models are not perfect. Like all machine learning models, AI-based predictive models are only as good as the data they are trained on. It is therefore important for insurers to carefully consider the quality of the data they use to train their models.

Despite the challenges, AI-based predictive modeling is a powerful tool that has the potential to revolutionize the insurance industry. By leveraging AI, insurers can improve their risk management, increase their revenue, reduce their costs, and provide better service to their customers.

How Does AI-Based Predictive Modeling Work?

AI-based predictive modeling works by using machine learning algorithms to identify patterns in data. These patterns can then be used to make predictions about future events. The specific steps involved in AI-based predictive modeling vary depending on the type of model being used. However, the general process is as follows:

- Data collection: The first step in AI-based predictive modeling is to collect data. This data can come from a variety of sources, such as policyholder records, claims data, and external data sources.

- Data preparation: Once the data has been collected, it must be prepared for analysis. This may involve cleaning the data, removing outliers, and creating features.

- Model training: The next step is to train the model. This involves using machine learning algorithms to identify patterns in the data.

- Model evaluation: Once the model has been trained, it must be evaluated to ensure that it is accurate and reliable. This can be done by using a holdout dataset or by cross-validation.

- Model deployment: Once the model has been evaluated and deemed to be accurate and reliable, it can be deployed into production. This means that the model can be used to make predictions about future events.

The Benefits of AI-Based Predictive Modeling for Insurance

AI-based predictive modeling can offer a number of benefits for the insurance industry, including:

- Improved risk assessment: AI-based predictive models can help insurers to better assess the risk of potential policyholders. This can help insurers to set more accurate premiums and avoid underwriting unprofitable policies.

- Fraud detection: AI-based predictive models can help insurers to identify fraudulent claims. This can help insurers to reduce their losses and protect their bottom line.

- Customer service: AI-based predictive models can help insurers to provide better service to their customers. For example, AI-based models can be used to identify customers who are at risk of churn and provide them with targeted offers.

- New product development: AI-based predictive models can help insurers to develop new products and services. For example, AI-based models can be used to identify new market segments or to predict the demand for new products.

- Cost savings: AI-based predictive models can help insurers to reduce their costs. For example, AI-based models can be used to automate tasks, such as underwriting and claims

Post a Comment